To most beginner forex traders, the term Forex spread is extremely foreign. In essence, however, the spread is essentially the difference between your Bid and the asking price. It’s what the brokerage charges you, basically the Forex broker. This is basically how the brokerage makes its cash. To fully appreciate the concept of Forex spread trading better, you’ll need to take a more in-depth look at this topic, detailing how to calculate them properly.

For instance, if you trade more with one of the major spread betting platforms, you’re probably dealing with one of the two types of spreads: the lower and upper spreads. The lower spreads involve trading one currency with one type of exchange rate and another currency with another. Typically, the smaller the spread, the lower the premiums for trading that particular currency. However, the larger the spreads, the greater the odds of arbitrage opportunities, resulting in substantial profit potential.

On the other hand, spread trading involves trading one currency with one type of exchange rate and another currency with another. So, it’s the type of arbitrage you need. One thing to notify is that since these prices (the bid price and ask price) are different, they have to be calculated differently.

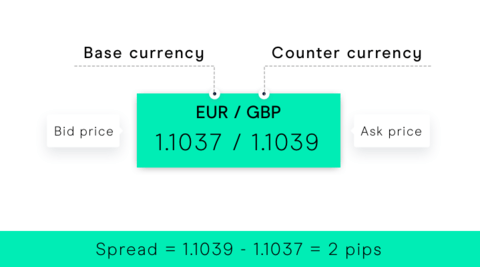

What is Spread?

The spread in terms of forex is the difference between the ask and bid price. The bid price indicates the pricing on which you can sell a currency, and the asking price indicates the pricing on which you can purchase a currency pair.

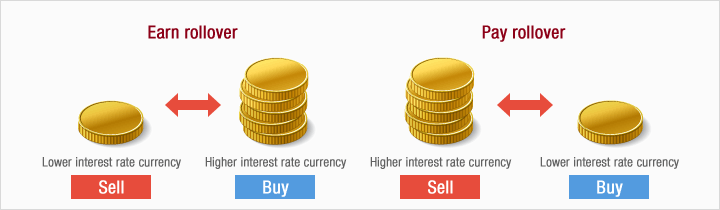

What is a Rollover?

When defined in terms of forex, the Rollover rate is the cost of carrying that regularly applies to your forex account. It is also named as “interest” or “swap” rate. A rollover defines the difference between two currencies’ interest rates that a trader either pays or earns while a certain position is kept open overnight.

What is an Order Volume in Forex?

Order volume defines the total number of standard lots you intend to trade-in.

Here:

- 1.00 indicates one std. lot (100,000 base currency units).

- 0.10 indicates one mini lot (10,000 base currency units).

- 0.01 indicates one micro lot (1,000 base currency units).