In the financial world, particularly in forex markets, a small but significant percentage in currency rate interest point of difference is an unchangeable unit in a trade. Trading with unchangeable money rates is known as zero-sum trading. This type of trading is usually considered risky since losses of principal amounts are unlimited, so extreme caution is required.

There are two types of pip in the forex market – one is the short-term pips, which occur during a day; and the other is the long-term pips, which occur over a week or more. The short-term pips, also called small-scale pips, occur due to changes in economic indicators like the gross domestic product (GDP), interest rates, unemployment rate, inflation, and stock market indexes, among others. Most traders tend to buy the gurus’ products (the short-term pips) and sell the do-about (the long-term pips) at the same time, thereby making large profits. The danger of a pip in the forex market comes from the fact that when major news or economic events occur, the market participants’ abnormal reaction creates an unforeseeable outcome. Unpredictable outcomes (unexpected economic conditions) may lead to catastrophic losses, wipe out all previous profits.

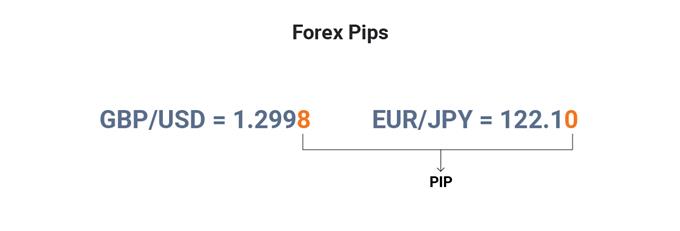

Forex Pip

Pip is the percentage in point or price interest point that showcases a unit of change within an exchange rate associated with a currency pair.

Most experienced traders are aware of pip in forex trading. However, novice traders should also learn this since the market is so unpredictable. The information you need to know on a pip in forex trading influences the different currencies, the factors that cause unexpected results, and how to react to these events when they happen effectively. It is only through proper knowledge and experience in trading that you will be able to gain a foothold in this volatile market.

How is the Value of Pip Calculated?

This value can be calculated by simply multiplying one pip, i.e., 0.0001, with a particular contract or lot size. While considering a standard lot, it comprises 100000 units associated with the base currency. While considering mini lots, it is 10000 units.