How central banks affect the forex market has been bothering many people for a long time now. If you have any knowledge in economics or the forex market, you must know how central banks work. Central banks control the money supply of a country and influence its economy in any way they wish. The level of money supply that a country has also affected other economic aspects of a country. Central banks usually fix interest rates, keep a stable exchange rate and intervene in the Forex market if they see any signs of a financial disturbance in the market.

Depends on How Central Banks Are Willing to Intervene

The central banks influencing the forex market is based on how they decide to intervene. There are times when the central bank has to intervene to maintain the exchange rate; there are times when it has to do its bit to prevent a major currency from falling, and there are times when it does all its thinking to bring back a currency which is rapidly losing ground in terms of its value. So how central banks affect the forex market can be described in two ways: they can control it or intervene and influence the exchange rate. This section will briefly discuss how central banks affect the forex trading course and how they decide on the intervention techniques.

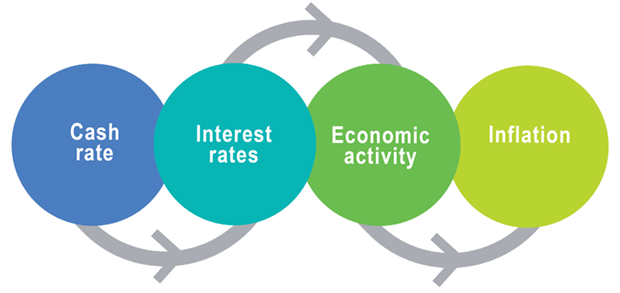

Usually, they take a wait and watch approach as they have to wait to see whether the currency pairs impact the foreign trade surplus before they decide to intervene. This is how central banks affect the forex market; they intervene concerning certain currency pairs when they feel a need to do so. Sometimes, the interest rates go up or down, which is also a kind of intervention technique. Central banks might use interest rates to control the forex trading course.

Monetary Policy of Central Banks Affecting the Forex Market

Central Bank’s influence over the currency market cannot be ignored when debating the central bank’s monetary policy and the FX market. The role of central banks in stabilizing an economic market or nation is debated heavily in the US and many other nations around the world today. While some believe central banks should not have any role in stabilizing a nation’s economy, others openly debate that only a central bank can prevent a nation from plunging into economic ruin, thus causing hyperinflation.

On the other aspect of the currency, those that support the central bank’s monetary policy feel that government involvement in the currency market is necessary to keep inflation under control. Consumers and businesses do not experience deep inflation, which could lead to hyperinflation. However, critics of central bank intervention argue that the vast majority of central bank interventions to date, especially during the recent crisis, have not effectively prevented hyperinflation. The currency market did recover after the Great Recession, just like it did following the previous intervention. These critics also point out that history does not reflect a consistent pattern of positive inflation rates and declines.

In light of these arguments, the current debate between central bank intervention and the currency market can be largely split down into two camps: those that believe the central bank’s monetary policy and the FX market are beneficial for both the central bank and the economy, and those that believe the central bank’s monetary policy and the currency market damage the economy. Whether or not the central bank’s monetary policy and the currency market are beneficial or detrimental to an economy has been at the core of many economic debates throughout history. Although no blanket statement can be made regarding this debate, it seems to be a debate with strong pros and cons for both sides. The central bank’s intervention to date has helped stabilize currency markets and helped restore confidence in the US dollar. However, those that have questioned the benefits and validity of the central bank’s monetary policy may wish to reconsider as recent events in the currency markets seem to indicate that the benefits may soon outweigh the downside risks.