Different Types of Forex charts: Forex Charts are used to depict the movement of prices of currencies over some time. The prices of currencies can change from one minute to the other within the same day. These charts are essential for any trader who wants to trade in Forex. Although there are many forms of forex charts available in the market, only a few are common-Line charts, Bar charts, and candlestick charts. The term ‘Forex chart’ refers to any chart that depicts currencies’ price movement in the market.

These forex charts are available for all major currencies and are useful for traders planning to enter or exit the exchange market for a particular currency pair. The trend lines drawn on the charts may be horizontal, vertical, or curved. The points that form the trend line are termed trend line points. The height of the line may vary from zero to the maximum allowed level. The size of the points on the chart may also vary from small to large values. These points show the opening and closing prices of the exchange.

The main types of charts are based on price/weighted averages, the moving average convergence-divergence, and the simple moving average.

Line Charts

Line charts in Forex are often used to highlight the key features of an investment, and they may be used to show the price of the investment over time. There is much more to line charts in Forex than just that. They have turned out to be so useful that many companies have their line charts in Forex dedicated solely to that purpose. It’s no longer considered uncommon to see a commodity or company name displayed on the line chart, and this is not just a passing trend.

A trend line in Forex describes the study of an economic asset, which is based on the interpretation of certain areas on the chart. These areas often hold valuable information for the investor, and by joining these areas with other technical indicators, the trend line is drawn.

Bar Charts

If you have a basic knowledge of bar charts in financial analysis, you can understand how bar charts are in forex work. Foreign exchange brokers widely use forex or foreign exchange charts to predict future market trends. Forex charts are visual representations of real-time currency price movements from one currency to another. A Forex chart is used to get an image representation of how a particular currency pair at actual exchange price moves over time. It provides an easy method to analyze past price movements and current price activity.

Forex trading charts are usually used in day trading or short-term trading of currencies to give you an overview of the market trend. Bar charts in forms provide data for both the long-term and short-term market trends. You can see the trend of the currency over some time. You can plot different bar charts in force for better trading strategies.

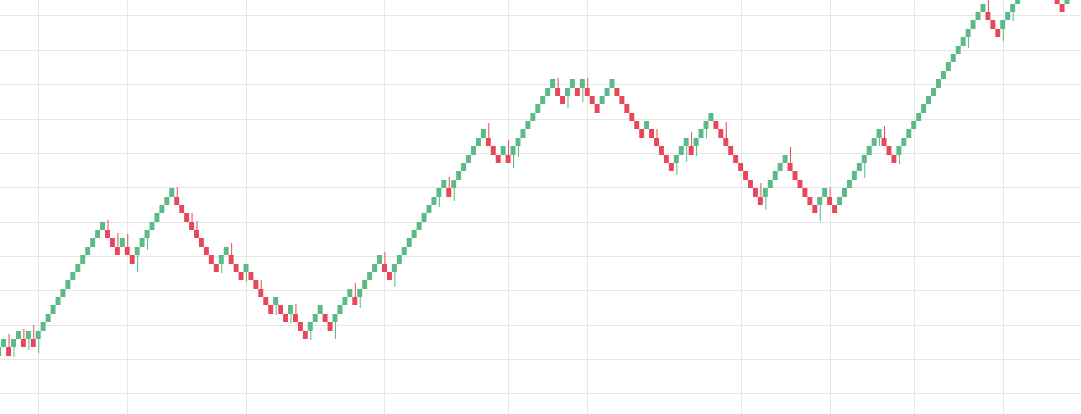

Candlestick Charts

Candlestick patterns are by far the most prominent types of technical analysis charts in currency trading. As they offer an extremely clean and alluring way of representing price trends, candlestick charts have been used for centuries to predict market behavior. Candlestick patterns are also highly effective in Forex because they do not rely on outside information to provide their information, allowing them to be used with zero confirmation. As a result, candlestick charts in Forex offer extremely high levels of efficiency, allowing traders to trade with very little information and in extremely low-risk settings.

There are several distinct advantages to candlestick trading as compared to another form of technical analysis charts. Firstly, candlestick charts in Forex are simple to understand and to read. They offer a great degree of clarity about the price action, often down to the level of a single candle. This means that candlestick charts can be used as an introduction to technical analysis for new traders. They can be used to get a feel for what price action is like when using other methods of technical analysis. In addition to this, it means that there is a direct relationship between the size of a candlestick and its movement in the price, meaning that the bigger the candlestick, the quicker its movement away from the trend and the smaller the size of the candlestick, the slower the movement within the trend.