An advantage of dealing with forex providers is the increased liquidity that comes with liquidity providers. Most traders these days are relying on liquid markets, where most CFD contracts are traded. The lack of full-service brokers on the market makes the market maker the only person who has a lot of liquidity, and therefore it is the one who determines the price you pay.

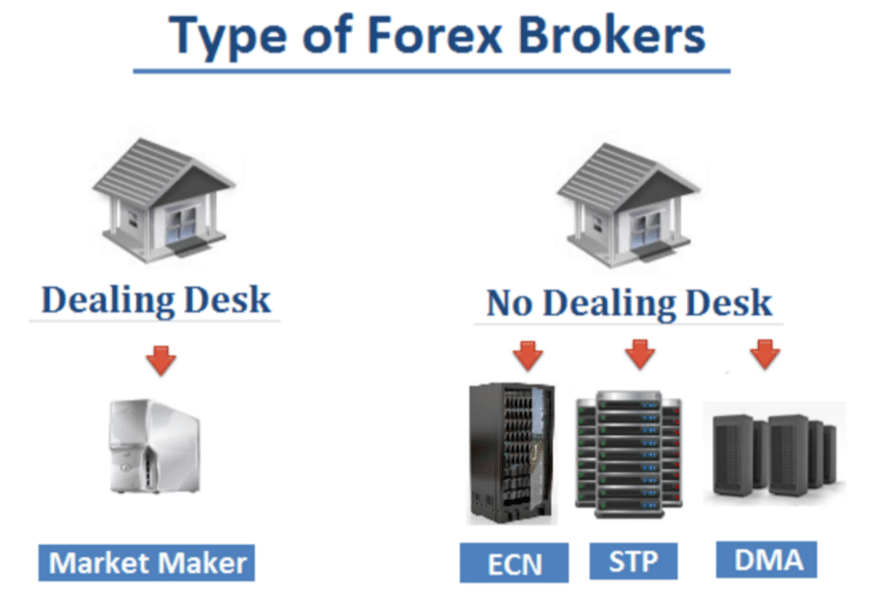

Here remain the two most common types of forex providers:

1. Dealing Desk Forex Provider

On the other hand, a dealing desk broker acts as liquidity providers, and they do this by providing you with access to CFDs from major financial institutions. The main advantage of trading without a dealing desk forex broker is the price transparency that it offers. When you trade with CFDs, you pay to buy a product (the contract), and then you pay to sell it (the order). You have no idea whether you should be paying less for an item or more for it – you pay whatever the market dictates. Because this is done on a short-term basis, you end up with small losses that you can live with – until the next trading week when the next CFD set will hit the market

2. Non-Dealing Desk Forex Provider

With the introduction of the non-dealing forex broker in the market, there is a possibility of saving upon a large portion of the transaction cost while trading with non-dealers. The main issue to be focused on in this regard is to make sure that the dealer you will deal with has a good reputation in the market. While this will not guarantee the non-dealing forex broker as good a reputation as the dealer dealing directly with the trader, it will lower the risk to the trader by a significant margin.