What is Forex?

An Insight into Forex: Forex is “foreign Exchange” or “FX.” It is the buzzword among many traders. This is because this market keeps you in touch with all the international markets round the clock. You can buy and sell currencies from all corners of the world using the internet or your preferred brokers and trading systems. The Forex market is somehow like the stock market. Instead of shares being bought and sold on a public platform, it is the trading of currencies where the price is determined by the current demand and supply of the particular currency in the global market. Forex is the largest and most liquid foreign exchange market. It involves the trade of currencies, both bought and sold. It also involves all aspects of trading, such as buying, selling, trading, and trading again.

How Does FX Trading Work?

Foreign Exchange happens in currency pairs. In this, you purchase one currency while selling another, ensuring that you profit throughout the process. For instance, let’s say that you invested in two currencies, EUR/USD/JPY. You decide that you would like to get rid of EUR by selling it and buying back the USD with the money from your EUR sale. This is the basic operation of forex trading. You will also need to learn how the economic factors are going and how the foreign currency exchange market works. This information is very easy to attain through the use of an automated software tool.

What are the Forex Trading Hours?

The FX market remains open 24 hours a day. It works only five days a week while foreign currencies are traded throughout the financial centers. It opens at 10:00 PM GMT on Sunday and closes at 10:00 PM GMT on Friday.

- Tokyo: Remains open from 12:00AM to 9:00AM GMT.

- Sydney: Remains open from 10:00PM to 7:00AM GMT.

- New York: Remains open from 1:00 PM to 10:00 PM GMT.

- London: Remains open from 8:00AM to 5:00PM GMT.

Is Forex Trading Expensive?

One of the biggest questions asked by new investors to currency traders is “Is Forex Trading Worth it in my Budget?” The simple answer is, “it depends.” It depends on the leverage and amount of capital invested. It can be as low as $50 or as high as the sky. Just remember that higher leverages come up with higher risks. It all depends on how much the trader can bear. Experienced traders learn the art of maximizing profits and limiting risks by understanding the market trends and money management scenarios.

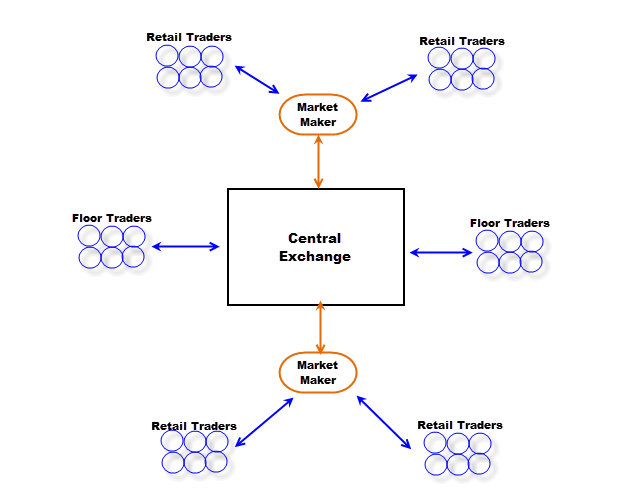

Where is the Forex Market Central Location?

Forex doesn’t go like the stock market when it comes to the central location, which a central platform from where all the operations are executed. In the forex market, there is no central exchange. Here, the transactions are performed between two traders (counterparts) through the phone or any electronic medium. That’s why the forex market is also known as an ‘Interbank’ or ‘Over-the-Counter’ (OTC) market.