The different types of forex analysis are technical, fundamental, and chart analysis. Technical analysis looks at past price action to predict the future price action in the market. Fundamental analysis, on the other aspect, looks at the economic fundamentals in the particular country. Charting is used to look at different forex analysis types such as moving average lines, line charts, and bar charts.

The forex analysis generally falls into three categories, namely technical, fundamental, and sentiment analysis. Technical analysis is based on trends in price movements and has to do with predicting price movement. Technical traders look to see how price movements follow a known trend and then try to find support and resistance levels in the trend that they follow. In more, though, it is not just looking at the trend, but looking at the data and interpreting it. Because this can take some time, many technical traders look to look for signals in the market.

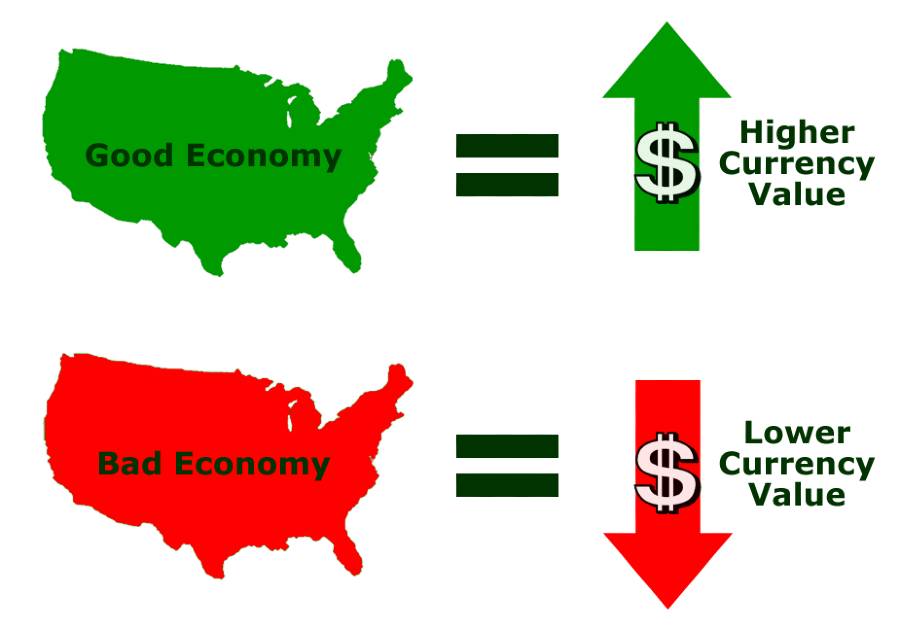

Fundamental analysis, on the other hand, is not based on trends in price movements. Instead, fundamental analysis looks at the economic indicators of a particular country or currency. Technical traders look at the news from the government and central banks, and international news agencies to interpret these price movements. If you are wandering to make money trading forex, it is important to know the different types of forex analysis to make the right moves in the market. Start looking up information on the different types of forex analysis for a particular currency and determine where the trend is going before you make trades.

Fundamental Forex Analysis

To make a profit in the fundamental forex market, you need to understand how to carry trade and analyze volatility. Volatility is the measure of how the price of a certain currency pair is shifting every second as it makes its way around the different exchanges. Fundamental analysis is used to try and decipher why a currency pair is having this amount of volatility. This article will examine the importance of fundamental analysis when trying to understand currency price movements.

The main reason fundamental forex market analysis is used, besides trying to make a profit, is to explain why certain currency pairs have a certain amount of volatility. What happens is that these currency exchange rates are compared to other currencies in the same category. This allows you to predict where the exchange rates may go next, especially if you can make predictions about future price movements. This can get particularly useful for people who understand the market well enough since it lets them trade with more confidence.

Technical Forex Analysis

The technical Forex market analysis looks into the different trading signals in the Forex market that can give you a chance to profit. Technical Forex trading is mainly concerned with the technical analysis used by people interested in trading currencies, particularly the major pairs. These pairs include GBP/USD, USD/JPY, EUR/CHF, GBP/JPY, USD/JPY. Technical analysis uses technical indicators, such as reports, historical data, price and economic calendars, fundamental and key economic indicators that can identify potential trends between currencies, and even more.

Another factor that is taken into account in technical forex market analysis is the presence or absence of a market leader. If the market shows a trend of one direction, then technical indicators can indicate that the market may head back in the same direction. It is also very important to remember that market leaders do not always act predictably. Sometimes, the market may move in an unpredictable direction, thus leading to different opportunities for traders.